39 fixed coupon note term sheet

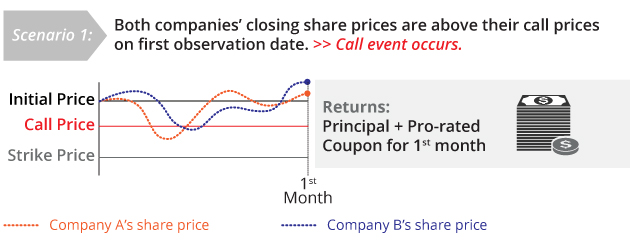

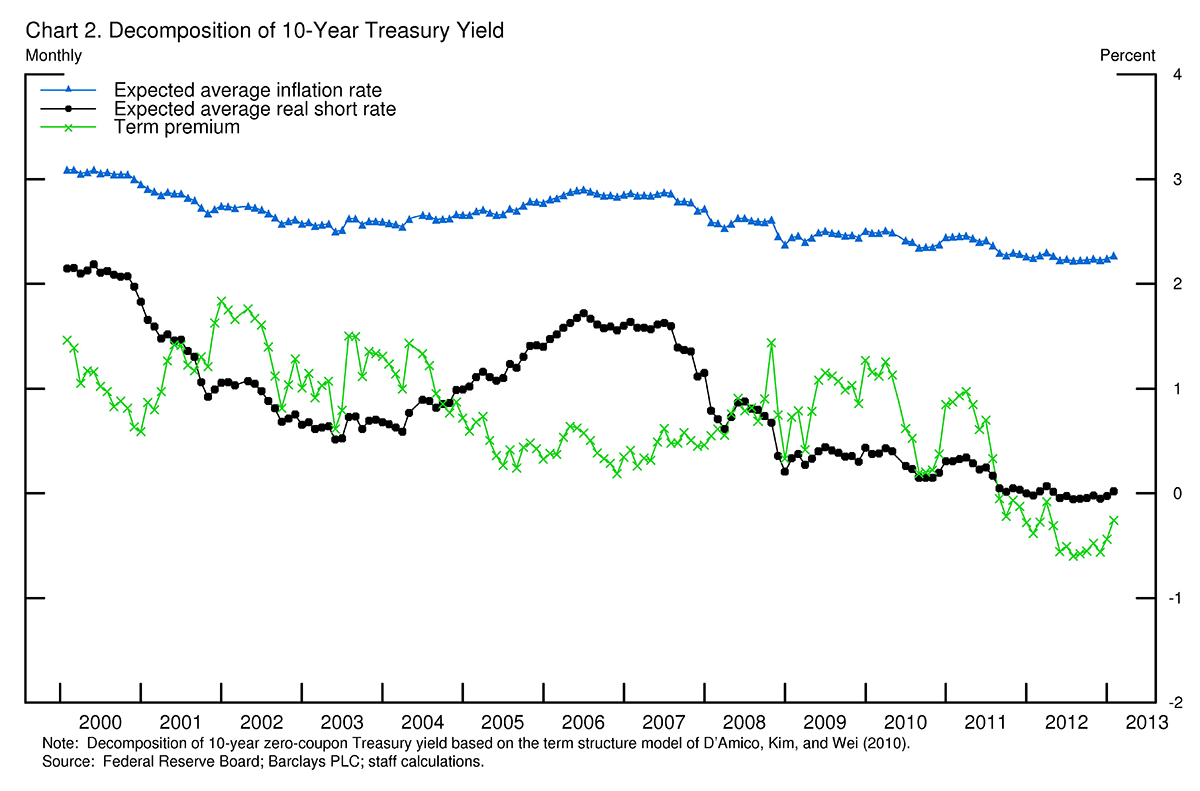

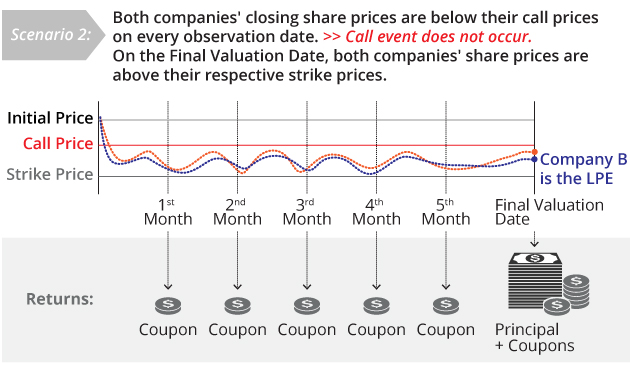

PDF Structured Products - CTBC Private Bank Fixed Coupon Note Such note features a fixed coupon paid to the investor periodically irrespective of the performance of the underlying asset. There is a callable feature whereby the Note will be redeemed earlier (autocall) if the underlying asset price is at or above the barrier/autocall level on/during any observation date/period. ... Equity-Linked Notes (ELN) Best Practices - Confluence Fixed Coupon and Initial Equity Price can be sourced from the term sheet or trade ticket. Annualized Coupon Rate = Fixed Coupon Rate * Initial Equity Price; Input the calculated variable rate using Add Variable Rate. Effective Date (1109): populate with Dated Date from the SMF; Variable Rate (96): annualized coupon rate calculated from the ...

Fixed Coupon Notes | DBS Treasures FCNs are a type of equity-based structured note. They provide regular coupon payments to the investor regardless of market conditions. Investors can either get their principal back in full, plus coupons, or they are "put" (or contractually obligated to buy at a specific price) the worst performing stock in a basket of equities, plus the ...

Fixed coupon note term sheet

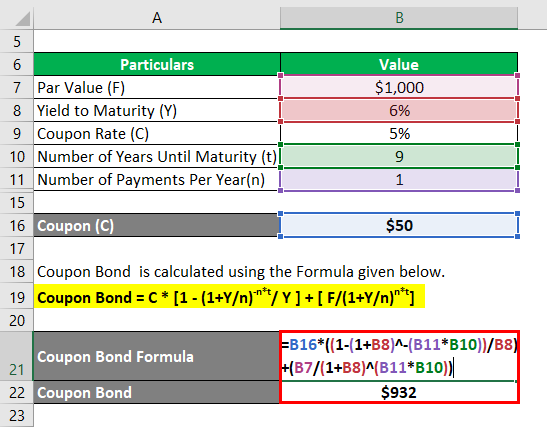

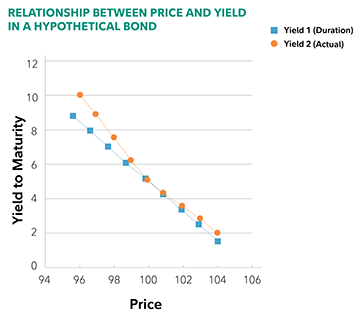

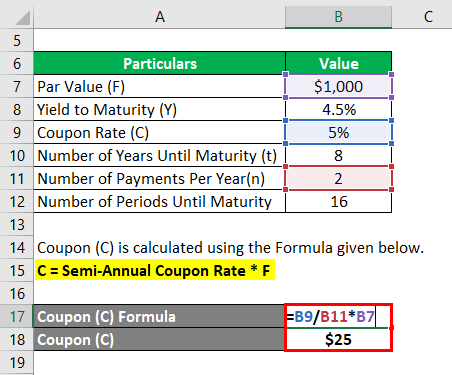

Equity Linked Notes (ELNs) | DBS Treasures In discussion with their bankers or stock brokers, investors choose the stocks and ELN yields that suit them. They then invest the principal amount at a discount, which represents the yield on the ELN. ELNs have a " strike " price, which is at a discount to the "spot" market price, and is expressed as a percentage of the " spot ". Equity-Linked Note (ELN) - Overview, Features, Benefits An equity-linked note (ELN) refers to a debt instrument that does not pay a fixed interest rate. Instead, it is a type of structured product whose return is linked to the performance of its underlying equity. The equity tied to an equity-linked note can be a security, a basket of securities, or a broader market index. What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

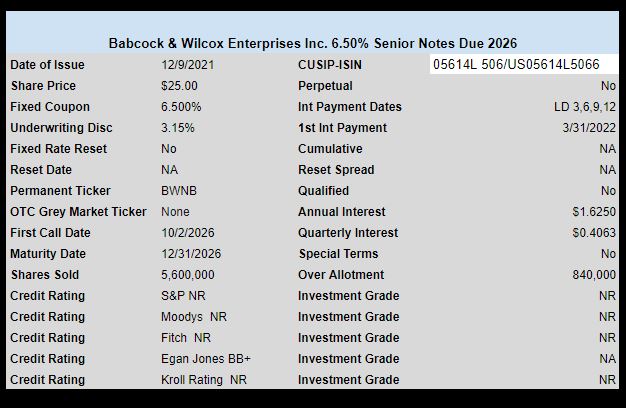

Fixed coupon note term sheet. PDF Fixed Income Structured Notes - RBC Capital Markets Callable Fixed Rate and Step-Up Notes Fixed Rate Notes have "fixed" interest rates for their entire term. Step-Up Notes have a "fixed" interest rate for a specified period which increases at predetermined dates in the future. These notes come with a "call" option which allows the issuer to redeem the security prior to its maturity. Private Lending Term Sheet: Typical Investment Terms and ... - Carofin A Summary of Terms (often called a Term Sheet) like the one described below, should be created and agreed to before you privately lend to a business. This document is the simplest way for each of the Lender and Borrower to specify the deal they are making, and a Term Sheet should be the basis upon which the other closing documents are drafted ... Understanding structured notes - MoneySense A structured note is a debt obligation of the issuer of the structured note. The issuer of the structured note usually pays interest or returns to investors during the term of the notes. The interest paid may be a fixed coupon or calculated according to a formula which is linked to one or more underlying reference asset (s) or benchmark (s). Fixed Coupon Notes (FCNs) | DBS Private Bank FCNs are a type of equity-based structured note. They provide regular coupon payments to the investor regardless of market conditions. Investors can either get their principal back in full plus coupons, or they are " put " (or contractually obligated to buy at a specific price) the " least performing equity " (or worst performing stock ...

PDF The Bank of Nova Scotia Extendible Fixed Rate Coupon Notes Final Term Sheet Extendible Fixed Rate Coupon Notes Final Term Sheet Issuer: The Bank of Nova Scotia (the "Bank") Issue: The Bank of Nova Scotia Extendible Fixed Rate Coupon Notes ... There is no selling agents' commission payable in respect of the Notes. Coupon Rate and Coupon Periods: The Coupon Rate will be payable semi-annually on each Interest ... Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100. Coupon Rate = (20 / 100) * 100. Coupon Rate = 20%. Now, if the market rate of interest is lower than 20% than the bond will be traded at a premium as this bond gives more value to the investors compared to other fixed income securities. Structured Products Basic Products, sample term sheet and pricing Term Sheet. This 5-year SGD Equity-Linked Structured Deposit ("SD") offers depositors an opportunity to have yield enhancement linked to the relative performance of an equity index and a bond index. An Interest Rate of 4.00% per annum* is payable if the return of the equity index is greater than or equal to the return of the bond index ... Zero-Coupon Bond: Definition, How It Works, and How To Calculate A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between...

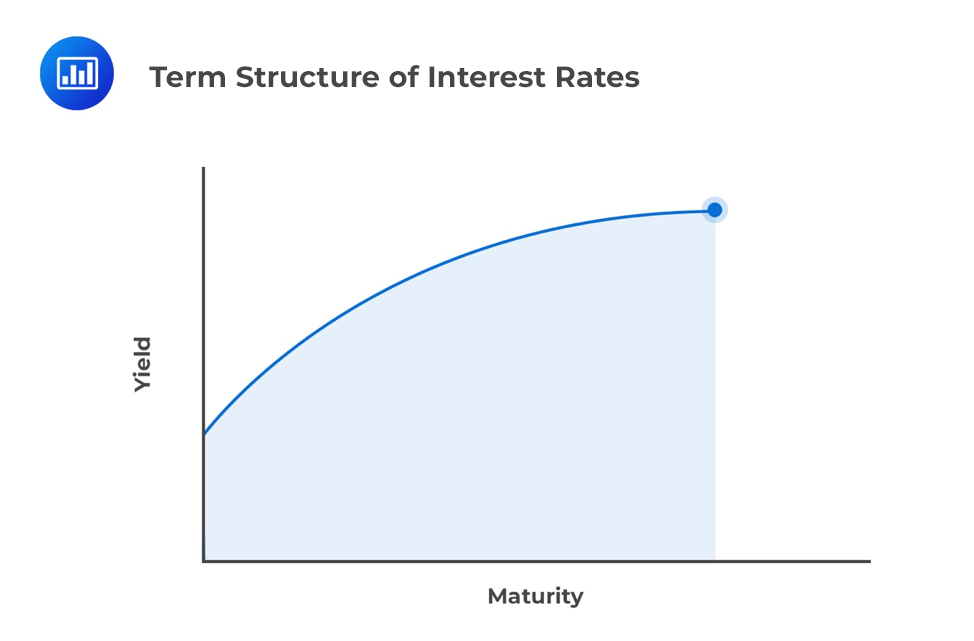

Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep Education Funding (i.e. Long-Term Savings for Children) Zero-coupon bonds are often perceived as long-term investments, although one of the most common examples is a "T-Bill," a short-term investment. U.S. Treasury Bills (or T-Bills) are short-term zero-coupon bonds (< 1 year) issued by the U.S. government. Learn More → Zero Coupon Bond (SEC) Structured products | Investments - HSBC SG Structured Products are designed to facilitate highly customised risk-return objectives. Structured Products are generally fixed-term investments and you should be able to commit to them for the full tenor of the product. If a Structured Product is terminated prior to its maturity (early unwind), you may get back less than your initial investment. Medium-Term Note (MTN) - Overview, How It Works, Advantages Generally, when comparing fixed-income securities, all else being equal, medium-term notes will come with a higher stated rate or coupon rate than shorter-term notes. It is because, to compensate for the risks associated with lending money for a longer period of time, an investor will demand a higher yield. Structured Notes with Principal Protection: Note the Terms of Your ... While structured notes with principal protection have the potential to outperform the total interest payment that would be paid on typical fixed interest rate bonds, these notes also might underperform a typical fixed interest rate bond and could earn no return for the entire term of the note, even if you hold the note to maturity.

PDF The Toronto-Dominion Bank Fixed Rate Senior Notes Final Term Sheet - td.com Coupon: Fixed at 2.260% per annum, interest payable in equal semi-annual payments in arrears on January 7 and July 7 of each year, commencing July 7, 2022, subject ... The delivery of this Term Sheet, the issue of the Senior Notes and any sale of the Senior Notes

Fixed Coupon Notes - Standard Chartered Singapore Introduction to Fixed Coupon Notes (FCNs) Fixed Coupon Notes (FCNs) are equity-linked structured notes where investors receive an unconditional periodic coupon. FCNs are for investors with a stable or moderately bullish market outlook. They enable investors to customize the risk-return profile of traditional assets and obtain investment ...

Term Note: Definition & Sample - ContractsCounsel A term note, or a term loan, is a type of loan in which the borrower receives a lump sum of money up front, but most adhere to predetermined borrowing terms. Typically, before receiving the term note, a borrower will agree to repay the loan based on a fixed repayment schedule with either fixed or floating interest.

PDF The Bank of Nova Scotia Extendible Fixed Rate Coupon Notes Final Term Sheet Extendible Fixed Rate Coupon Notes Final Term Sheet Issuer: The Bank of Nova Scotia (the "Bank") Issue: The Bank of Nova Scotia Extendible Fixed Rate Coupon Notes extendible semi-annually at the Bank's option starting May 26, 2024 to a maximum term of approximately 7 years (the "Notes"). The Notes will be direct senior unsecured and ...

Definition Equity-Linked Note (ELN) - Investopedia An equity-linked note (ELN) is an investment product that combines a fixed-income investment with additional potential returns that are tied to the performance of equities. Equity-linked notes are...

PDF Structured Notes - Asia-Plus "Fixed Coupon Notes (FCNs)"is a type of structured notes that underlied on assets such as individual stock, stock indexes etc. Investing in FCNs, investors can invest between 1-6 months and get monthly coupon. One of significant features of FCNs is an autocallable feature, a right for issuer to make early redemption. ...

Treasury Bonds | AOFM Treasury Bonds are medium to long-term debt securities that carry an annual rate of interest fixed over the life of the security, payable semi-annually. Indicative yields for Treasury Bonds are published by the Reserve Bank of Australia. Treasury Bond lines Information Memorandum Pricing Formulae Market makers

PDF RBC Capital Markets | Home RBC Capital Markets | Home

Callable Range Accrual Notes | FINCAD The notes may have time-varying notional, fixed coupon rate, and accrual rate ranges. ... For example, if there is a 25% chance of calling the note before the jth coupon date (i.e., there is a 75% chance of not calling the note before the jth coupon date), then the valuation procedure should give 75% of the vega risk of the floorlets that make ...

ELN -- Equity Linked Note -- Definition & Example | InvestingAnswers An ELN is a principal-protected instrument generally intended to return 100% of the original investment at maturity, but deviates from a typical fixed-coupon bond in that its coupon is governed by the appreciation of the underlying equity. An ELN has fixed-income features, like principal protection, as well as equity market upward exposure.

PDF The Bank of Nova Scotia Extendible Fixed Rate Coupon Notes (Bail-inable ... Extendible Fixed Rate Coupon Notes (Bail-inable Notes) Final Term Sheet Issuer: The Bank of Nova Scotia (the "Bank") Issue: Extendible Fixed Rate Coupon Notes, extendible semi-annually at the Bank's option starting April 22, 2020 to a maximum term of 10 years (the "Notes"). The Notes will be direct senior unsecured and unsubordinated ...

What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

Equity-Linked Note (ELN) - Overview, Features, Benefits An equity-linked note (ELN) refers to a debt instrument that does not pay a fixed interest rate. Instead, it is a type of structured product whose return is linked to the performance of its underlying equity. The equity tied to an equity-linked note can be a security, a basket of securities, or a broader market index.

Equity Linked Notes (ELNs) | DBS Treasures In discussion with their bankers or stock brokers, investors choose the stocks and ELN yields that suit them. They then invest the principal amount at a discount, which represents the yield on the ELN. ELNs have a " strike " price, which is at a discount to the "spot" market price, and is expressed as a percentage of the " spot ".

Post a Comment for "39 fixed coupon note term sheet"