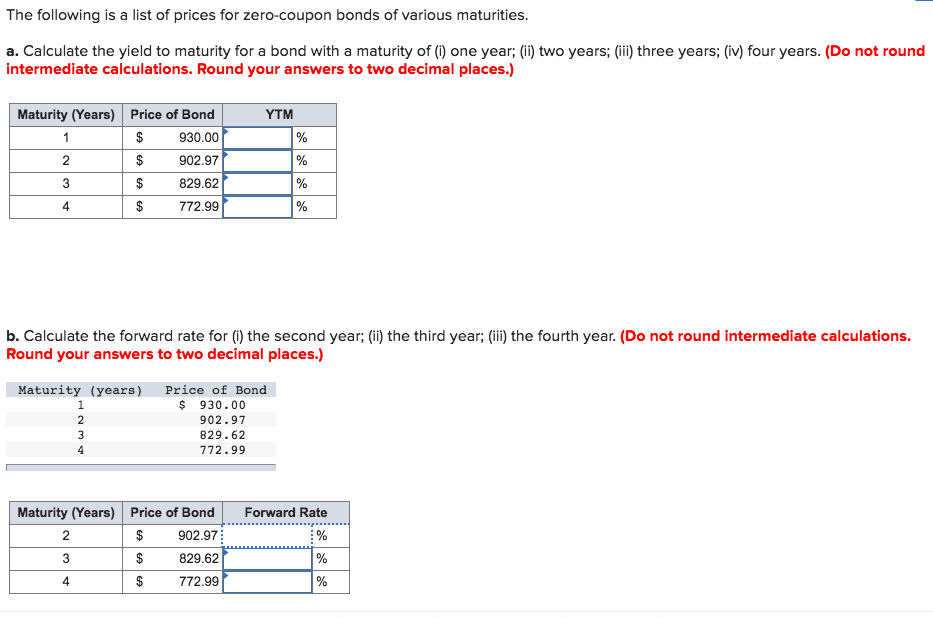

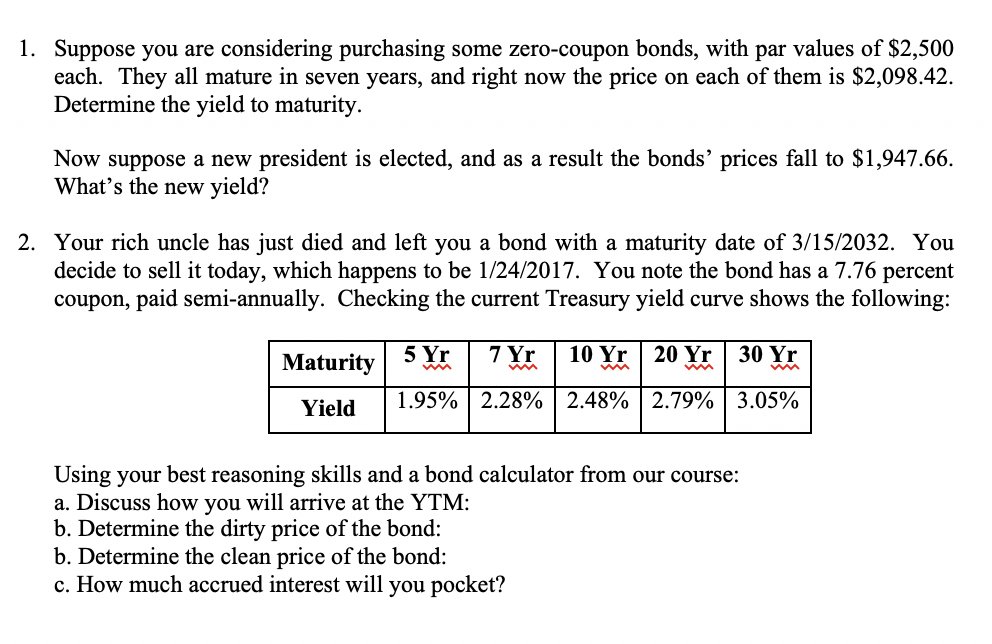

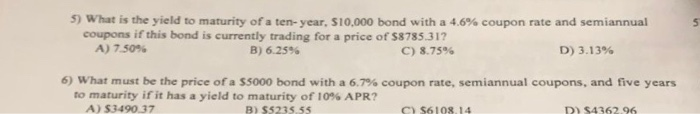

45 yield to maturity of zero coupon bond

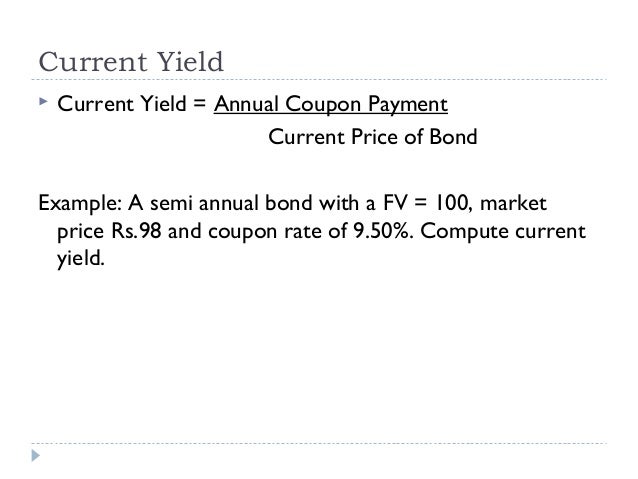

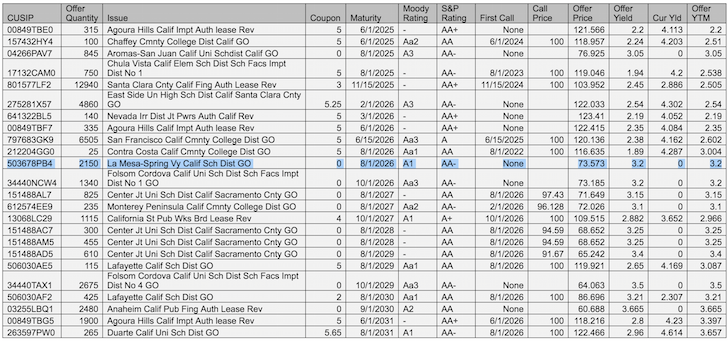

Current Yield vs. Yield to Maturity: What's the Difference? That's why the yield to maturity is only 2.99%. In contrast, the XYZ 3.15% bond's current market price is $980, a discount to the $1,000 face value. Its current yield of 3.2% and its yield to maturity of 3.48% are higher than its coupon rate because of the discount. Estimate yield of coupon bond given yield of zero coupon bond The yield on a discount (zero-coupon) bond maturing in 2010 should be higher than that of a coupon bond maturing in 2010 under the stated circumstances. This is because some of the cash flow of the coupon bond will be realized earlier than that of the discount bond, and as shown in the table below, the yield curve, as far as these two bonds are ...

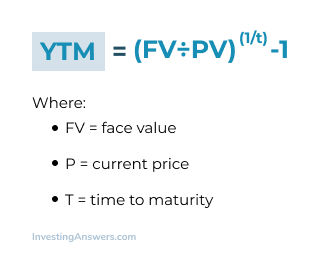

OneClass: What is the yield to maturity (YTM) of a zero coupon bond ... What is the yield to maturity (YTM) of a zero coupon bond with a face value of $1,000, current price of $940 and maturity of 9 years? Recall that the compounding interval is 6 months and the YTM, like all interest rates, is reported on an annualized basis.

Yield to maturity of zero coupon bond

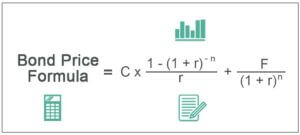

› Zero-Coupon-BondZero Coupon Bond Yield - Formula (with Calculator) For example, an investor purchases one of these bonds at $500, which has a face value at maturity of $1,000. Although no coupons are paid periodically, the investor will receive the return upon maturity or upon sell assuming that the rates remain constant. Zero Coupon Bond Effective Yield Formula vs. BEY Formula. The zero coupon bond effective ... Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity How Does the IRS Tax... dqydj.com › bond-yield-to-maturity-calculatorBond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward:

Yield to maturity of zero coupon bond. Zero Coupon Bond: Calculate the YTM (yield to maturity) Consider a zero-coupon bond with a $1000 face value and 10 years left until maturity. If the bond is currently trading for $459, what is the yield to maturity on this bond? Show calculations. Please show all calculations with. › terms › yYield to Maturity (YTM) Definition - Investopedia Nov 11, 2021 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... en.wikipedia.org › wiki › Yield_to_maturityYield to maturity - Wikipedia Then continuing by trial and error, a bond gain of 5.53 divided by a bond price of 99.47 produces a yield to maturity of 5.56%. Also, the bond gain and the bond price add up to 105. Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds How do I Calculate Zero Coupon Bond Yield? (with picture) The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check.

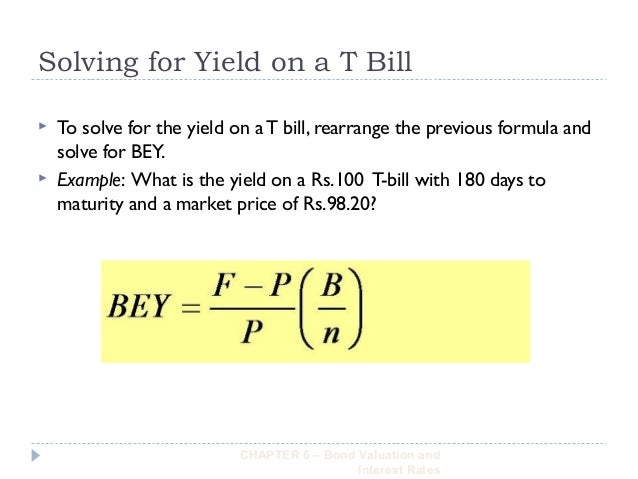

Yield to Maturity Calculator | Calculate YTM Determine the annual coupon rate and the coupon frequency; coupon rate is the annual interest you will receive by investing in the bond, and frequency is the number of times you will receive it in a year. In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a ... › zero-coupon-bondZero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. Should You Buy Treasuries? You know the yield to maturity before you buy the bond. The shortest U.S. bonds, T-bills, are sold at auction at a discount to the face value (par). Bills mature at par and don't pay interest. The stated yield to maturity and realized compound yield to... ask 5 The stated yield to maturity and realized compound yield to maturity of a (default-free) zero-coupon bond will always be equal. Why? Should a convertible bond issued at par value have a higher or lower coupon rate than anonconvertible bond at par?

EOF Basics Of Bonds - Maturity, Coupons And Yield To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010). The current yield has changed. Divide 4.5 by the new price, 101. calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months. Yield to Maturity - What it is, Use, & Formula - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is held to maturity. There are two formulas for yield to maturity depending on the bond. The yield to maturity formula for a zero-coupon bond: Yield to maturity = [ (Face Value / Current Value) (1 / time periods)] -1. The yield to maturity formula for a ...

Calculating the Effective Yield of a Zero-Coupon Bond To calculate the return for a zero-coupon bond, the following zero-coupon bond effective yield formula is applied: [{F/PV}]^(1/t) =1+r. Where. F -face value of the bond. PV- current value of the bond. t -time to maturity. r- Interest rate. For example, an investor purchases a zero-coupon bond at $ 200, which has a face value at maturity of ...

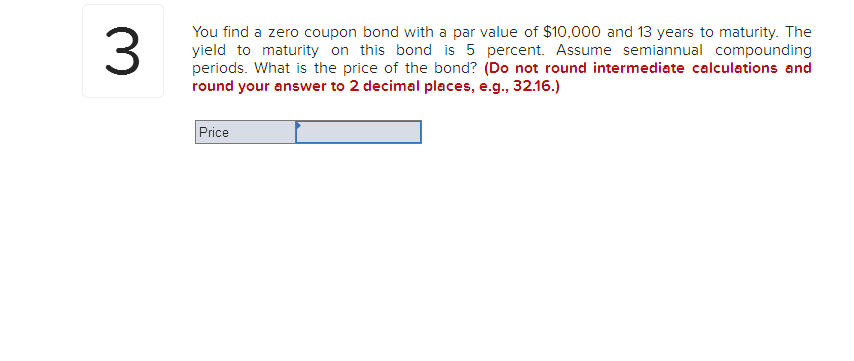

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05/2) 5*2 = $781.20 The price that John will pay for the bond today is $781.20.

What Is The Interest Rate Of Government Bonds This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. ... Zero-Coupon Bonds; How Can You Buy I Bonds. RBIs reluctance to budge on interest rates results in low demand for government ...

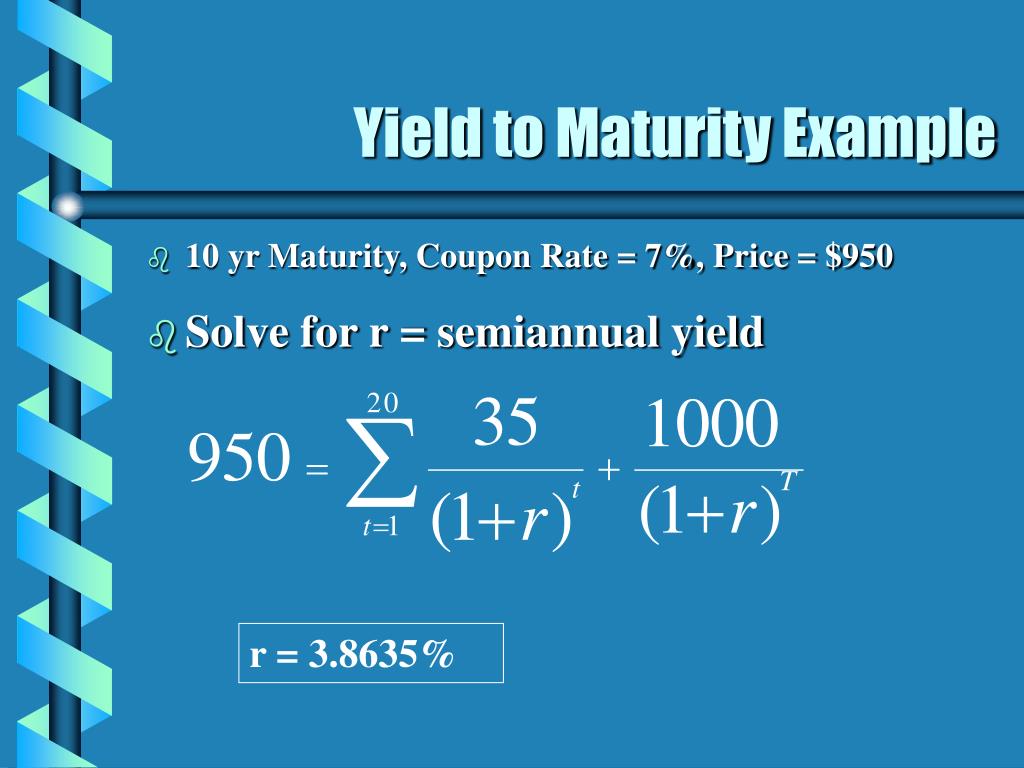

Yield to Maturity (YTM) - Overview, Formula, and Importance Assume that there is a bond on the market priced at $850 and that the bond comes with a face value of $1,000 (a fairly common face value for bonds). On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below:

› bootstrapping-yield-curveBootstrapping | How to Construct a Zero Coupon Yield Curve in ... Zero-Coupon Rate for 2 Years = 4.25%. Hence, the zero-coupon discount rate to be used for the 2-year bond will be 4.25%. Conclusion. The bootstrap examples give an insight into how zero rates are calculated for the pricing of bonds and other financial products. One must correctly look at the market conventions for proper calculation of the zero ...

Understanding Bond Yields and the Yield Curve #Bonds #YieldCurve # ... Understanding Bond Yields and the Yield Curve When it comes to investing in bonds, one of the first factors to consider is yield. But what exactly is "y

Calculating Yield to Maturity in Excel - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is held to maturity. There are two formulas to calculate yield to maturity depending on the bond. The yield to maturity formula for a zero-coupon bond: Yield to maturity = [(Face Value / Current Value) (1 / time periods)] -1.

How to Calculate Yield to Maturity of a Zero-Coupon Bond The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a...

dqydj.com › bond-yield-to-maturity-calculatorBond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward:

Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity How Does the IRS Tax...

› Zero-Coupon-BondZero Coupon Bond Yield - Formula (with Calculator) For example, an investor purchases one of these bonds at $500, which has a face value at maturity of $1,000. Although no coupons are paid periodically, the investor will receive the return upon maturity or upon sell assuming that the rates remain constant. Zero Coupon Bond Effective Yield Formula vs. BEY Formula. The zero coupon bond effective ...

:max_bytes(150000):strip_icc()/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)

Post a Comment for "45 yield to maturity of zero coupon bond"